intelligently automating

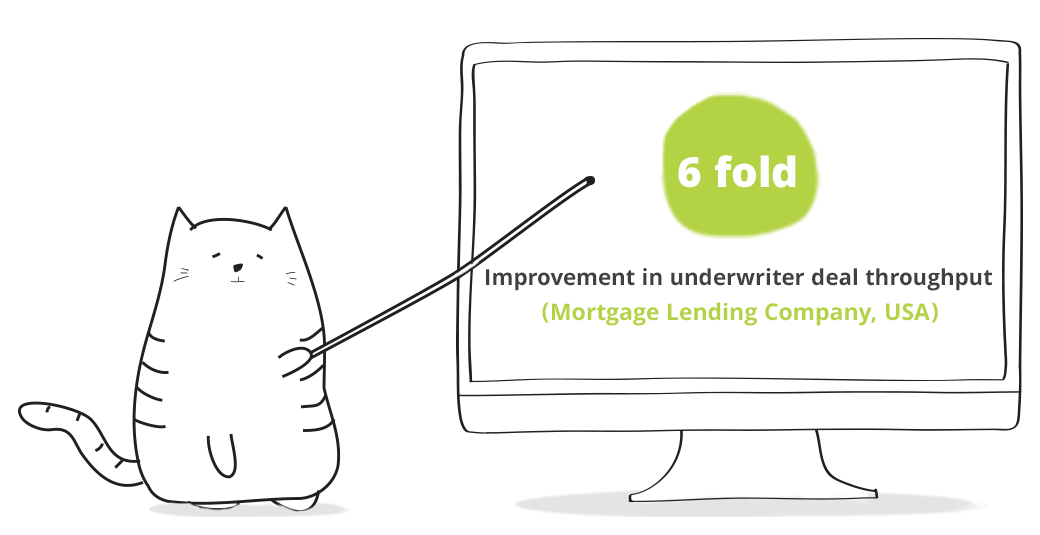

- robo underwriting

- robotic process automation

- mortgage originations

- manual processes

- document processing

- loss mitigation

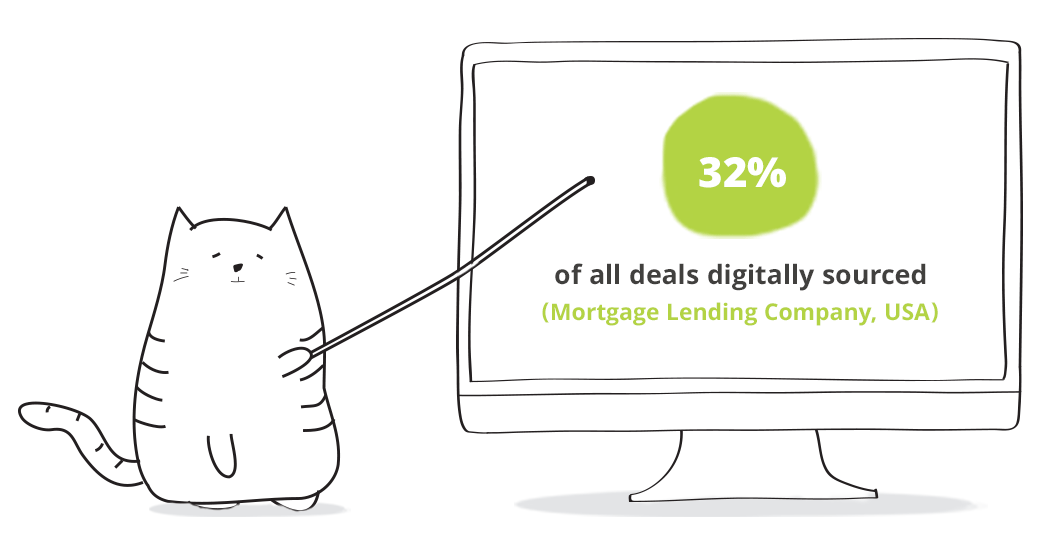

- digital marketing

- dynamic customer segmentation

- customer lifecycle management

- conversion optimization

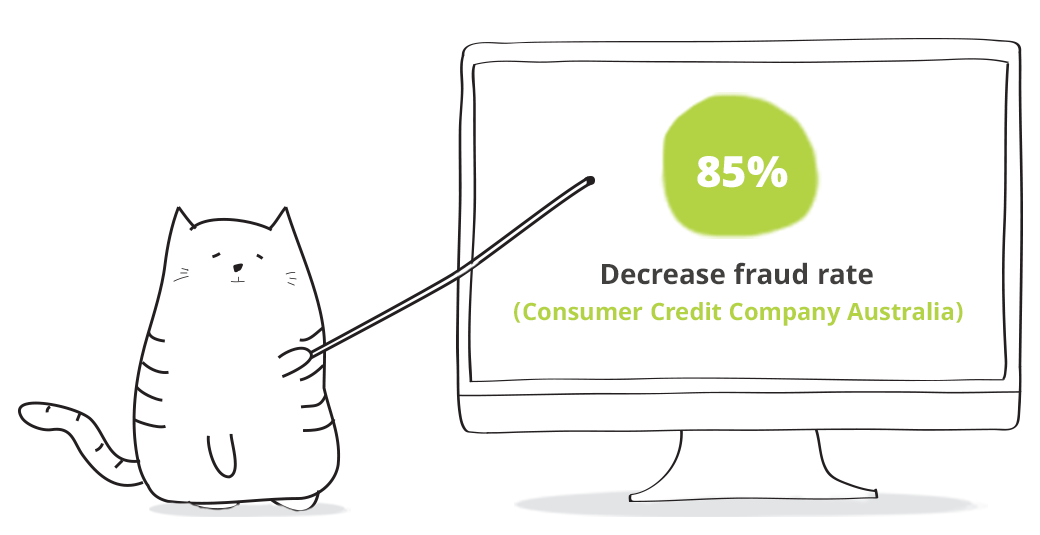

- fraud detection/prevention

- retention management

- risk adjusted pricing

- churn prevention

- collections optimization

- marketing campaign optimization

- cross-sell, up-sell

- user identification

- KYC

- user digital fingerprinting

- next-best-action

- mass personalization

- dynamic customer journey

- affordability prediction

- claims prediction

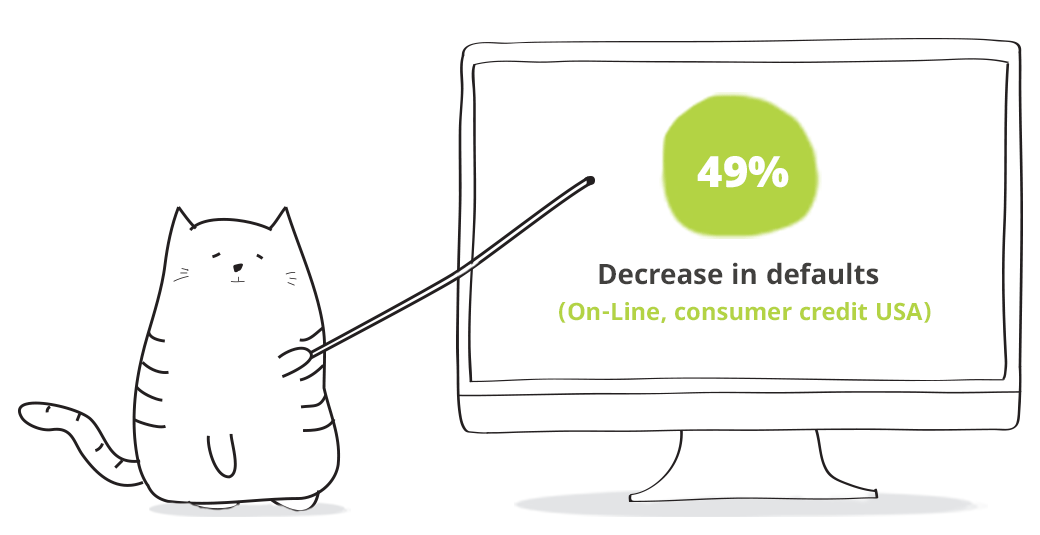

- default prediction

- lead evaluation

- limits management

our customers

zoral is the automation platform for:

sme/consumer & corporate finance,

banking, mortgage, insuretech

…and more

zoral automation is smart

designed from the start to use artificial intelligence and deep learning – adapts to individual customer behaviour – controls omni-channel customer experience – powers automation and digital transformation

zoral advanced automation functions

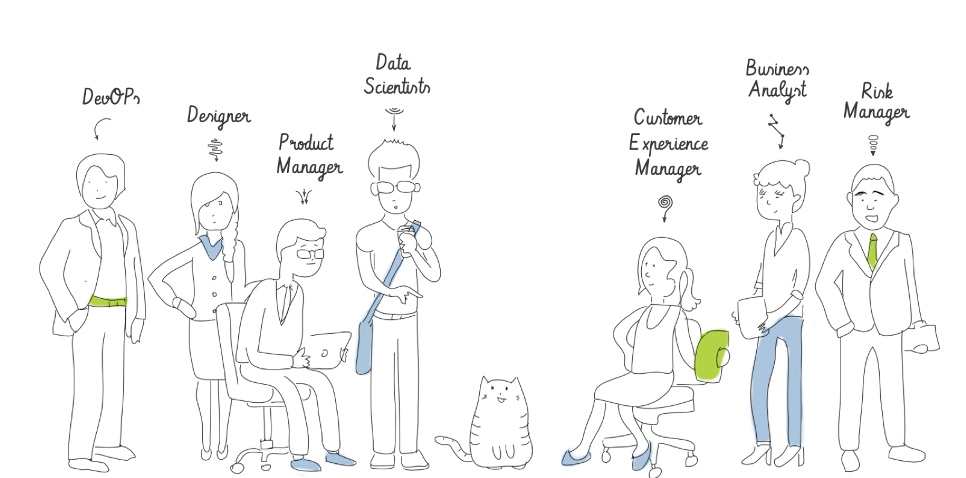

designed for your whole team

- easily launch digital products

- generate meaningful customer engagements

- establish omni-channels

- analyse customer behaviour

- simplify and optimise customer journey

- improve CX satisfaction KPIs over time

- intuitive, drag-and-drop UI

- design, test and deploy workflows models and rules

- create optimal CX journeys

- rapidly integrate your manual processes

- rapidly automate your manual processes

- easily add data sources

- launch new products rapidly

- easily adapt to changing market conditions

- real-time, historic, and predictive KPI monitoring and reporting

- full audit of all decisions and data

- GDPR compliance toolset

- advanced ai/ml functions

- non-linear, SVM, decision trees, baysian inference, markov chains, random forest, genetic algorithms, survival analysis, anomaly detection, etc.

- R, Python, any PMML compliant language

- retain all data/decisioning for regression testing and model evaluation

- model drift monitoring

- built-in analytical data warehouse

- micro services, 24/7 architecture

- system/services monitoring

- automated data quality monitoring

- SaaS, private cloud or on-prem deployment

- configurable operations consoles

- versioning, admin, and authorisation controls

rapid and easy

automation is complex, we’ve made it simple.

with zoral, from concept to production in 4 weeks is not just theory, we’ve done it.

benefit from our experience

at zoral, we’ve put in over 350 man-years into zoral automation platform.

we’ve delivered hundreds of automation projects and digital products throughout the world.

our tools, methodology and experience will save time & cost, while reducing risk.